What is AutoFinance?

Auto finance allows consumers to apply for preferential payment methods from auto finance companies when they need a car loan. They can choose different models and payment methods according to their needs.

What Classifications of Auto Finance?

- Car Loan (Motorbike/Boda boda/E-bike/Tuk-tuk Loan)

- After the debtor pays the down payment to the auto finance company, he obtains the vehicle title. He repays the loan and interest to the financial company monthly.

- Logbook loan

- The debtor mortgages the logbook of the owned vehicle to the auto finance company for a loan and repays the loan and interest to the financial company monthly. However, the right to use the vehicle still belongs to him.

- Financial leasing

- The debtor rents the vehicle and pays monthly rent. When the lease expires, the vehicle is returned to the financial company. Or the debtor can also buy the vehicle and pay the remaining price.

What Risks of Auto Finance?

- Debtor fails to repay the loan on time

- When the debtor fails to repay the loan on time and out of touch, if the auto finance company can’t manage and locate the vehicle, there will be a risk of bad debts and vehicle losses.

- The vehicle is stolen or damaged

- If a vehicle is stolen or severely damaged during the loan period, the lack of location data makes it difficult to find the vehicle and determine liability.

- Secondary Collateral

- If the vehicle is mortgaged for a second time, it may result in bad debts and vehicle losses. However, due to the inability to obtain vehicle data, financial companies cannot promptly identify whether the vehicle has been re-mortgaged.

How GPS Tracker Works for Auto Finance?

GPS tracker and monitoring system plays a very important role in risk control of auto finance company.

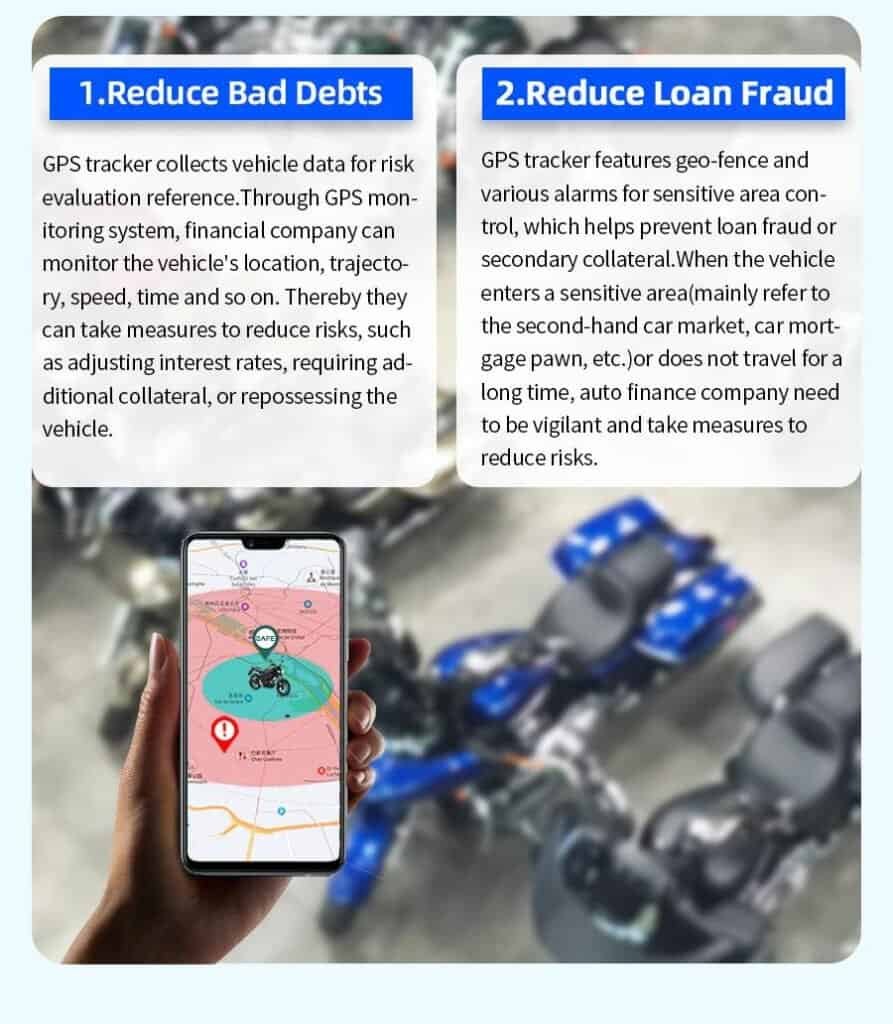

- Reduce Bad Debts

- GPS tracker collects vehicle data for risk evaluation reference. Through GPS monitoring systems, financial companies can monitor the vehicle’s location, trajectory, speed, time, and so on. Thereby they can take measures to reduce risks, such as adjusting interest rates, requiring additional collateral, or repossessing the vehicle.

- Reduce Loan Fraud

- GPS tracker features geo-fence and various alarms for sensitive area control, which helps prevent loan fraud or secondary collateral. When the vehicle enters a sensitive area(mainly refer to the second-hand car market, car mortgage pawn, etc.)or does not travel for a long time, auto finance companies need to be vigilant and take measures to reduce risks.

Effective Functions of GPS Tracker for Auto Finance.

- Real-Time Tracking

- Offering precise real-time vehicle location which enables auto finance companies to track the exact position of the vehicle and ensure asset security.

- Historical Playback

- GPS monitoring system supports trace playback up to 3 months and choose a certain period of time, offering a comprehensive data of vehicle movements.

- Geo-fence

- Enables sensitive area control to prevent loan fraud or secondary collateral. If a vehicle lingers in sensitive areas such as the second-hand car market or car mortgage pawn, alerts will be triggered, auto finance company will know promptly and take measures.

- Various Alarms

- GPS tracker features many alarms, such as light sensor alarms, power down alarms, vibration alarms, over-speed alarms, etc. If the device is illegally removed or someone tries to steal or break the car, alerts will be sent to the server immediately.

- Remote Cut-off Fuel and Power

- When something abnormal happens to the vehicle, the auto finance company can cut off fuel and power remotely to restrict the vehicle’s movement and prevent theft.

- Supporting Driving Behavior and Vehicle Data Detection

- It provides auto finance companies with a more precise risk assessment for their financial inventory during the loan period while serving as a data reference for renewal decisions.

Contact US to Get Solution Now!