Why Auto Insurance Tracker Exist?

Tracking devices allow auto insurance companies to accurately identify their safest drivers and reward them with discounts. The discounts are also an excellent way for insurers to attract new customers.

The devices also help auto insurance companies combat phony insurance claims. Part of the cost for those phony claims gets passed along to honest customers. Tracking devices help stop fraud and help keep insurance prices from rising.

How Auto Insurance Tracker Works?

1-1 What Data Is Tracked?

-Location

-Speed

-Hard braking

-Quickly accelerate

-Fast cornering

-Mileage

-Time of day, especially nighttime driving

-How frequently you drive

1-2 How the Data Works?

1-2-1 for daily management of insurance companies:

When the insurance company receives this data, they can determine whether a safe driver follows the rules of the road, or if the driver has poor driving habits, like frequently speed. The insurance company will use this data to set driver’s insurance rates.

1-2-2 for insurance companies to identify fake claims:

The data collected by the tracker may help the company identify fake claims and reduce losses from fake claims.

1-2-3 for anti-theft:

Both insurance companies and the driver can collect the data immidately once the car has been stolen to find the car easily and quickly. The insurance companies can reduce losses from the claim of car stolen.

1-2-4 for the users of insurance companies:

Insurance companies can provide customers with driving suggestions based on the driving data collected by the tracker, and finally guide customers to develop good driving habits.

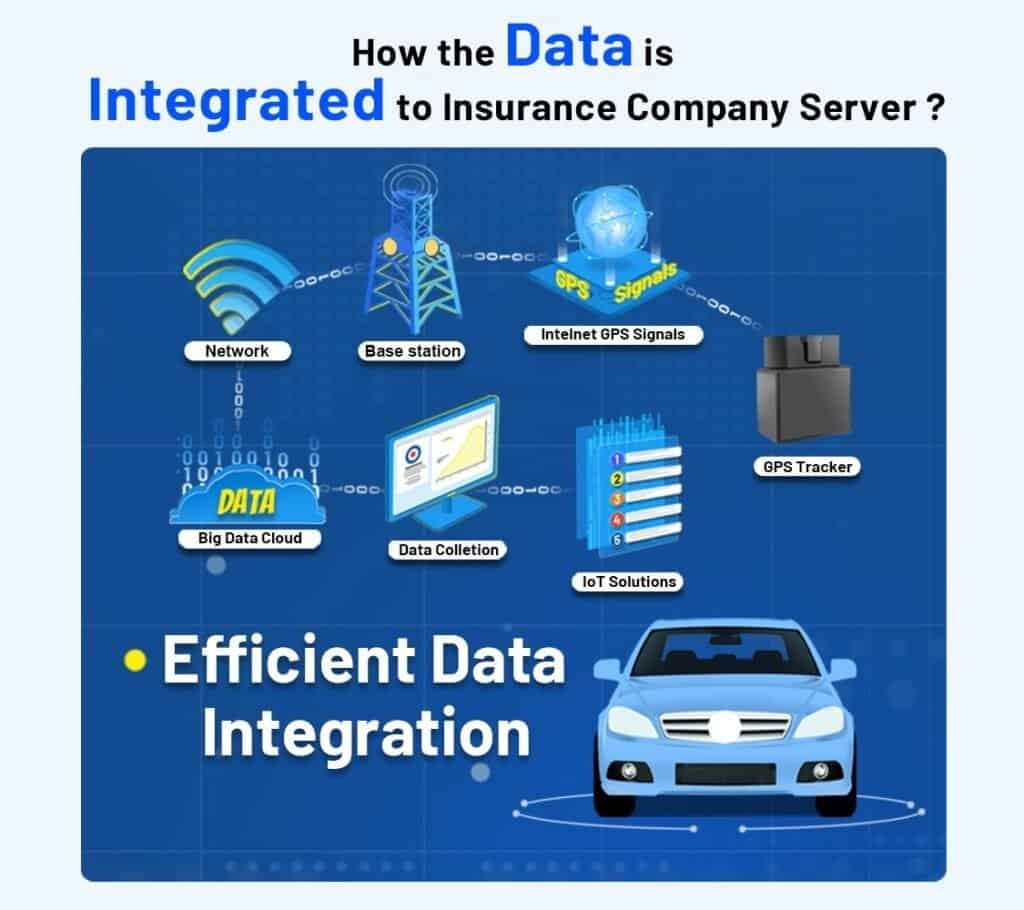

How the Data is Integrated to the Insurance Company Server?